Accounting

Accounting Automation Evolution: Augmented or Artificial Intelligence

What is the reality of Artificial Intelligence tools utilized today in your accounting practice? Unfortunately, there is no clear answer, and in actuality it depends on your interpretation of AI.

Feb. 24, 2023

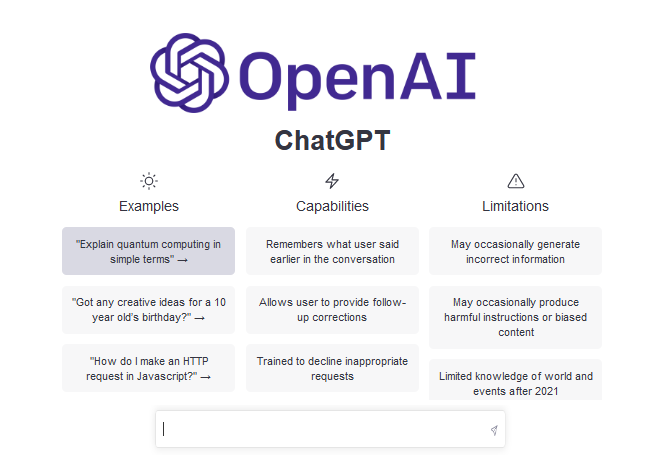

Technology has made significant contributions to the practice of accounting and is on the verge of another evolution with the advent of artificial intelligence tools coming into the mainstream. In the past four months there has been a frenzy around Open Ai’s ChatGPT, which is a natural language application where you can type in questions and get comprehensive answers in a format that is almost impossible to distinguish from that which you would expect from another educated human.

The AI platform allows you to “fine tune” responses with additional information, emphasis and corrections which is already being used by bloggers, journalists, and students to assist with their research and writing.

The writing is so good that some educational institutions have banned its use and journalists have been called out for relying on it to write their content rather than doing it themselves.

Recent accounting articles have focused on how such chat tools can be utilized for developing marketing content, analyzing and summarizing financial data, and possibly in providing online responses to common accounting questions. For instance, in customer support situations where there is a history of data that the “chat” responses can interpolate from, the most common answer to the scenario can be provided by the system.

But what is the reality of Artificial Intelligence tools utilized today in your accounting practice? Unfortunately, there is no clear answer, and in actuality it depends on your interpretation of AI and how you apply tools incorporating touting various “AI” capabilities.

ChatGPT is just one of many AI chat tools on today’s market, but it garnered over one million users in its first week of release because it was easy to use and extremely robust (having been trained with more than 175 BILLION data points selected by OpenAI prior to 2022). Artificial Intelligence applications utilize highly sophisticated algorithms and massive computer power to generate responses, but in the end are only as good as the data they have been trained on, which gets us to the point about using Artificial Intelligence applications within the accounting profession.

There is a slew of accounting applications that promote an “AI” moniker and state they utilize Artificial Intelligence, but in most cases these tools have been pre-programed and/or need the assistance of “super users” to become effective accounting tools as I believe they have not acquired enough data to effectively respond independently.

We have seen firms benefit greatly from accounting automation tools including spreadsheets, accounting applications and to some extent data extraction tools, which I would say are incredibly beneficial when utilized by a trained user for accounting purposes. This is particularly true when the super user’s previous experience and knowledge has been codified or scripted within the application and then fine-tuned by active users.

I would describe this as “augmented” intelligence rather than “artificial” intelligence, which by my understanding artificial intelligence would be that which is interpolated by the computer application (which is the case with the current wave of chatbots).

This is not to say that existing accounting applications and the tools we use to run our practices do not have some intelligence built in. There are multiple instances of scripted intelligence being utilized in our profession to automate processes with the best-known examples being the use of APIs (application program interfaces), ML (machine learning), and RPA (robotic processing automation) which are now entering mainstream use for most firms.

We are also seeing common applications intelligently suggesting corrections as evidenced by word-processing corrections in grammar and spelling and within spreadsheets providing hints to correct formulas. But what kind of AI would you consider these examples?

I believe, that for any automation technology, and in particular Artificial Intelligence, to make it into mainstream accounting practices, one of the key defining factors is that it has to be “consumer grade.” This means that it can be adopted by a broad audience with a minimal amount of effort and work as expected, the majority of the time.

Today, this is the case with ChatGPT and I believe that the capabilities of this application will make it into the mainstream of accounting firms when it is natively integrated into the tools we utilize regularly in our practices. Microsoft, as a major investor and builder of the ChatGPT platform and the network architecture on which it runs has considerable influence on the direction of ChatGPT and will bring it to our firms within their apps.

I believe we will first see computer generated AI within the Office applications (Excel, Word, Outlook, Teams, etc.) and then as these AI tools become more iterative and available at the commercial/consumer level, that we will see the major accounting vendors (Intuit, Thomson Reuters, WoltersKluwer, BNA, etc.) beginning to incorporate true AI capabilities into their applications in addition to the specific purpose “AI” tools that are being promoted to accountants today.

I believe AI tools will become integral to the work of accounting to automate the repeatable, rote work that most accountants dread freeing time to focus on those areas where unique knowledge cannot be easily codified, which is the work where accountants truly add value and best serve clients.

========

Roman H. Kepczyk, CPA.CITP, CGMA is director of Firm Technology Strategy for Right Networks and partners exclusively with accounting firms on production automation, application optimization and practice transformation. He has been consistently listed as one of INSIDE Public Accounting’s Most Recommended Consultants, Accounting Today’s Top 100 Most Influential People, and CPA Practice Advisor’s Top Thought Leaders